199A Worksheet By Business Activity

Introduction to the 199A Worksheet

The 199A worksheet, also known as the Qualified Business Income (QBI) Deduction worksheet, is a crucial tool for businesses and individuals to calculate their deductible business income. The Tax Cuts and Jobs Act (TCJA) introduced this deduction to provide tax relief to eligible business owners. In this post, we will delve into the details of the 199A worksheet by business activity, exploring its application, calculation, and implications.

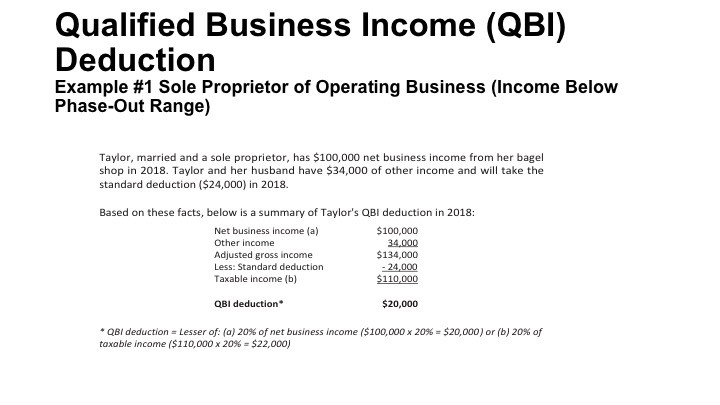

Understanding the QBI Deduction

The QBI deduction allows eligible businesses to deduct up to 20% of their qualified business income, subject to certain limitations and phase-outs. The deduction is available to sole proprietorships, partnerships, S corporations, and limited liability companies (LLCs) treated as pass-through entities. To qualify, the business must have qualified business income, which excludes certain types of income, such as capital gains and dividends.

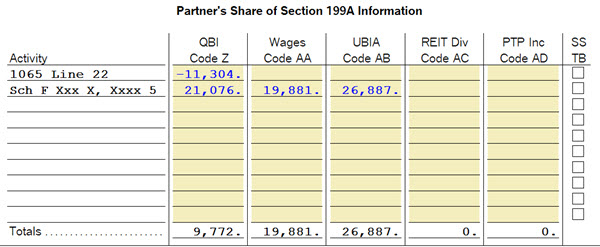

Business Activities and the 199A Worksheet

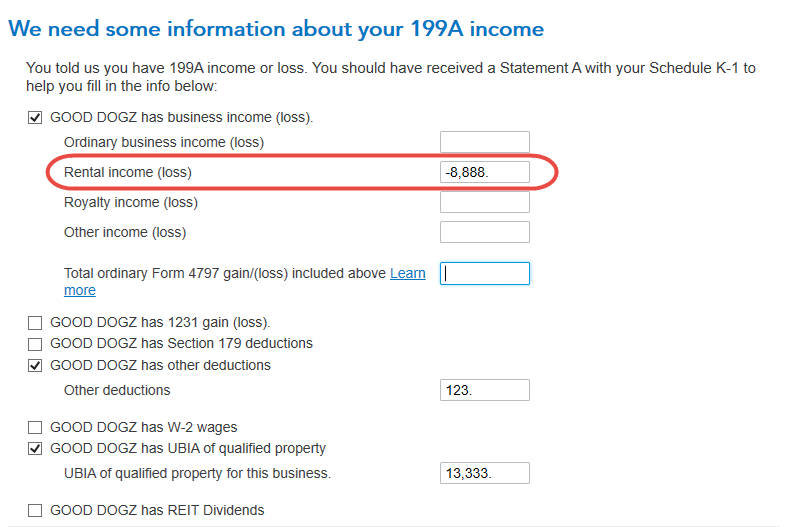

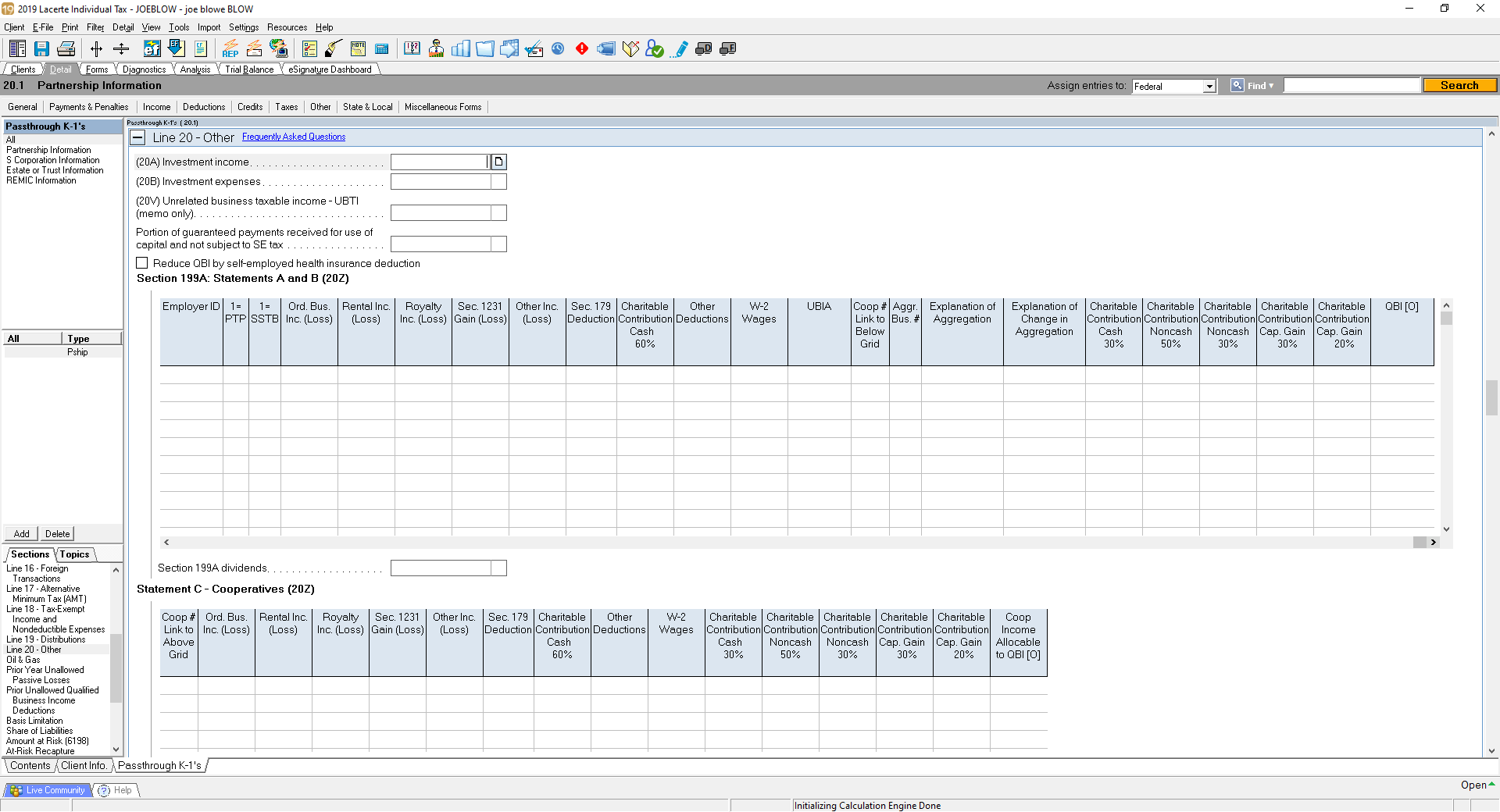

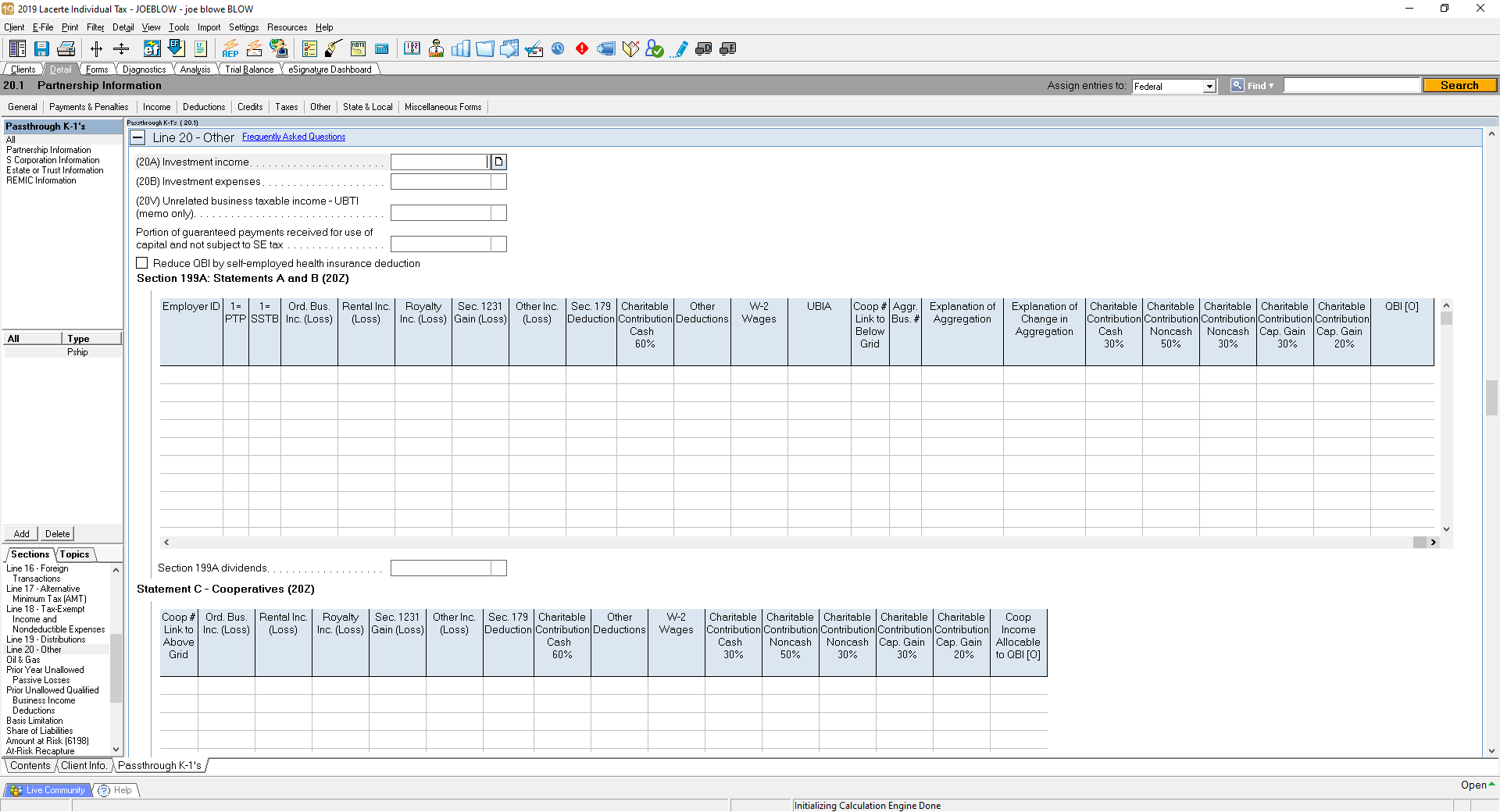

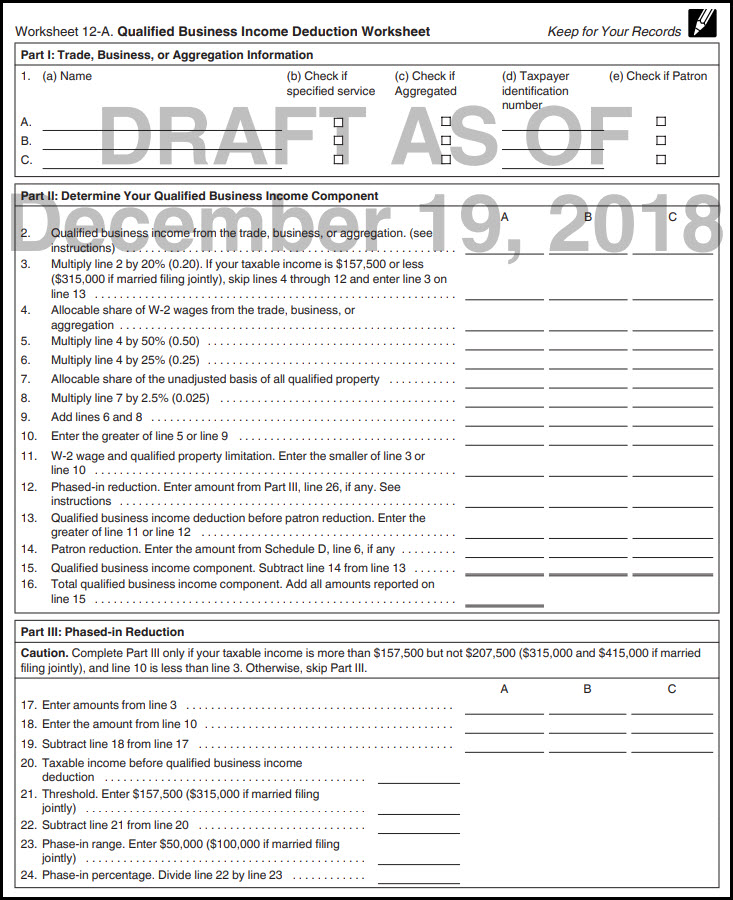

The 199A worksheet is organized by business activity, which is essential for calculating the QBI deduction. The worksheet categorizes business activities into several sections, including:

- Rental activities

- Trade or business activities

- Investment activities

- Other activities

Calculating Qualified Business Income

To calculate qualified business income, businesses must follow these steps:

- Determine the business’s total net income from all activities

- Exclude non-qualified income, such as capital gains and dividends

- Allocate business expenses to the qualified business activity

- Calculate the qualified business income for each activity

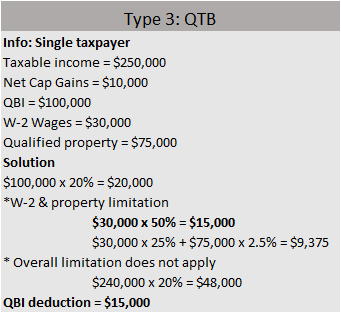

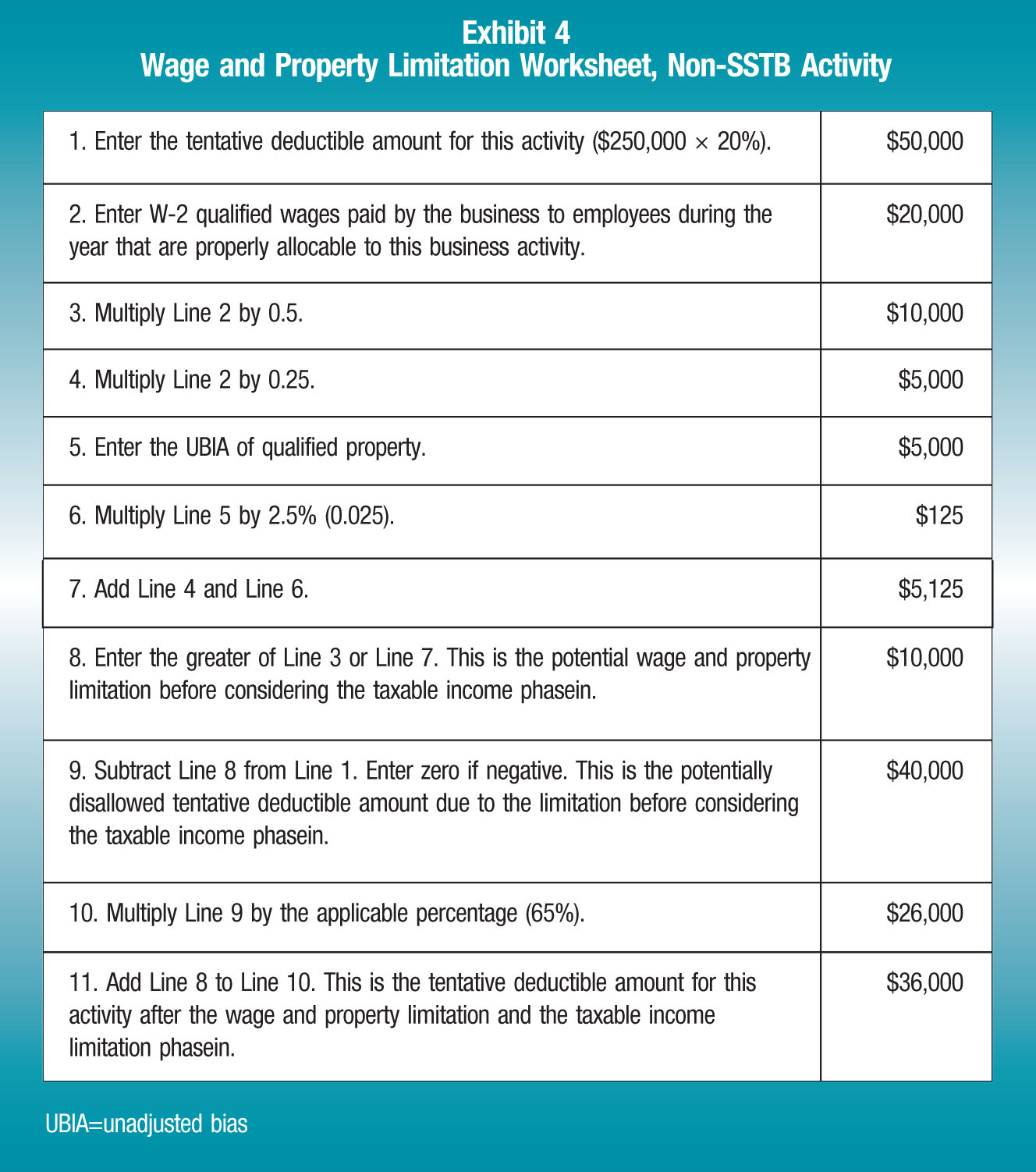

Limitations and Phase-Outs

The QBI deduction is subject to several limitations and phase-outs, including:

- The W-2 wage limitation, which limits the deduction to 50% of W-2 wages paid by the business

- The unadjusted basis immediately after acquisition (UBIA) limitation, which limits the deduction to 25% of UBIA of qualified property

- The phase-out ranges, which reduce the deduction for businesses with income above certain thresholds

Table: QBI Deduction Limitations and Phase-Outs

| Limitation/Phase-Out | Description |

|---|---|

| W-2 Wage Limitation | Limits the deduction to 50% of W-2 wages paid by the business |

| UBIA Limitation | Limits the deduction to 25% of UBIA of qualified property |

| Phase-Out Ranges | Reduces the deduction for businesses with income above certain thresholds |

📝 Note: The QBI deduction limitations and phase-outs can be complex and require careful calculation and application.

Conclusion and Key Takeaways

In summary, the 199A worksheet by business activity is a crucial tool for calculating the QBI deduction. Businesses must carefully calculate their qualified business income, apply the limitations and phase-outs, and consider the implications of the deduction on their tax liability. Key takeaways include:

- Understanding the QBI deduction and its application to different business activities

- Calculating qualified business income and applying the limitations and phase-outs

- Considering the implications of the QBI deduction on tax liability and business planning

What is the QBI deduction, and how does it apply to my business?

+

The QBI deduction is a tax deduction that allows eligible businesses to deduct up to 20% of their qualified business income. The deduction applies to sole proprietorships, partnerships, S corporations, and limited liability companies (LLCs) treated as pass-through entities.

How do I calculate qualified business income for my business activity?

+

To calculate qualified business income, you must determine your business’s total net income from all activities, exclude non-qualified income, allocate business expenses to the qualified business activity, and calculate the qualified business income for each activity.

What are the limitations and phase-outs that apply to the QBI deduction?

+

The QBI deduction is subject to several limitations and phase-outs, including the W-2 wage limitation, the UBIA limitation, and the phase-out ranges. These limitations and phase-outs can significantly impact the QBI deduction, making it essential to carefully calculate and apply them.

Related Terms:

- 199a specified service business examples

- beneficiary 39 s section 199a information worksheet

- how to calculate 199a deduction

- 199a activity summary worksheet

- 199a statement a summary form

- irs 199a worksheet instructions