199A Worksheet By Activity Form

Understanding the 199A Worksheet by Activity Form

The 199A worksheet by activity form is a crucial document for businesses, especially those categorized as pass-through entities, such as partnerships, S corporations, and sole proprietorships. This form is used to calculate the qualified business income (QBI) deduction, which can significantly reduce taxable income. The QBI deduction was introduced by the Tax Cuts and Jobs Act (TCJA) and is subject to various limitations and phase-outs, making the 199A worksheet an essential tool for navigating these complexities.

Who Needs to Use the 199A Worksheet by Activity Form?

Any business owner who files Form 1040 and has qualified business income from a domestic business operated as a sole proprietorship or through a partnership, S corporation, trust, or estate may need to complete the 199A worksheet. This includes a wide range of businesses, from small, one-person operations to larger entities with multiple partners or shareholders. It’s essential to determine if your business activity qualifies for the QBI deduction and to understand the specific rules and limitations that apply.

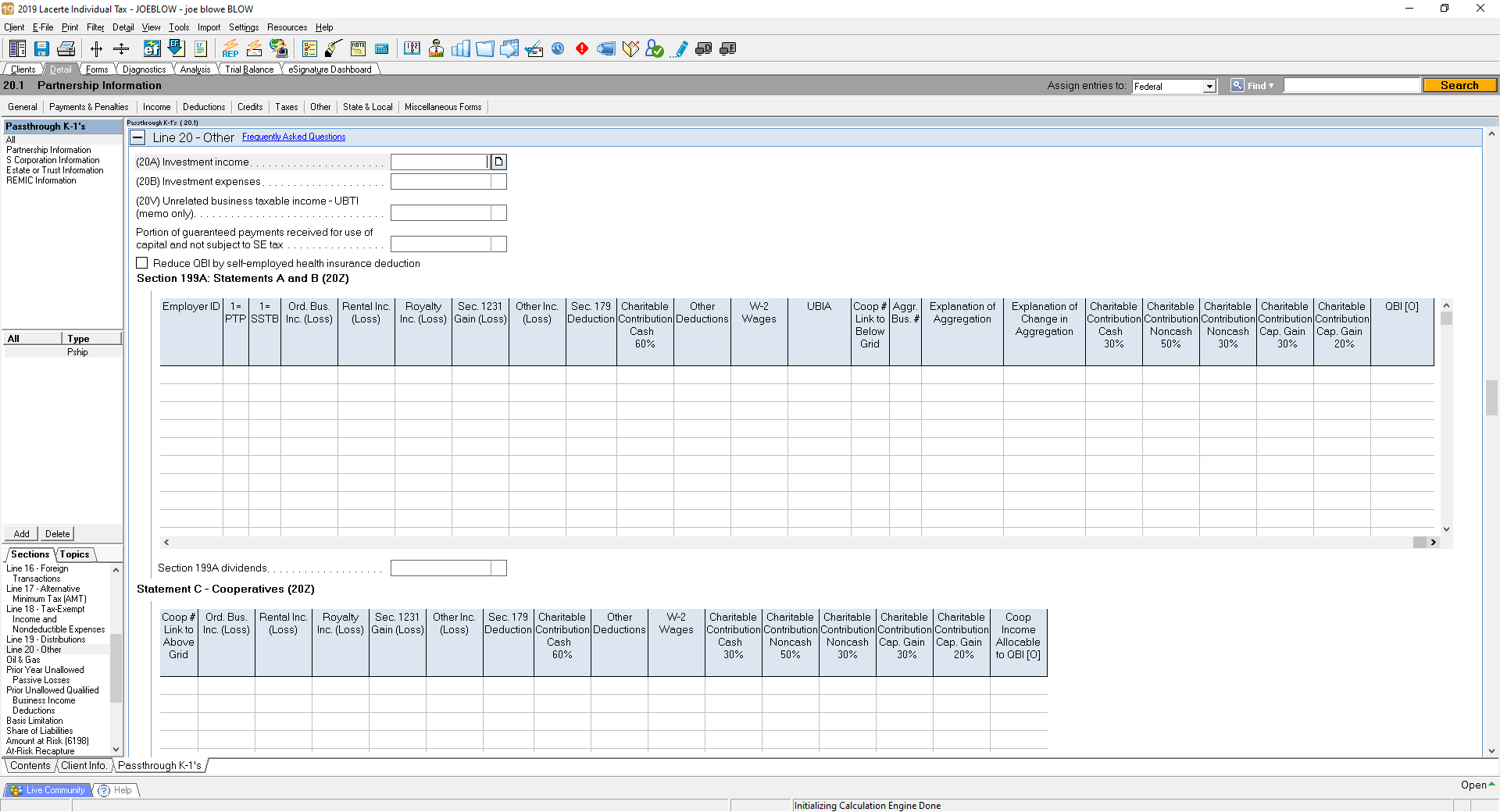

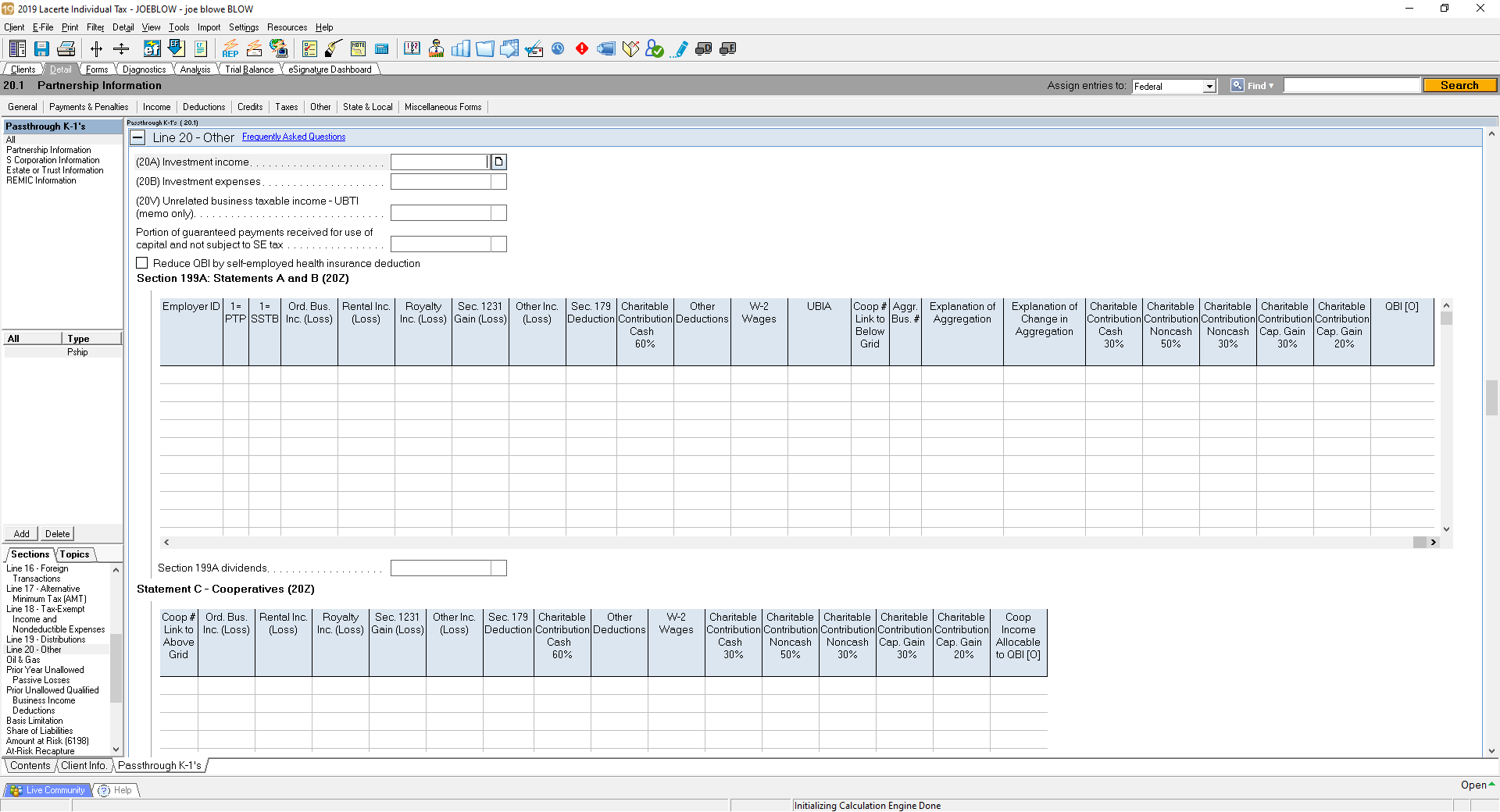

Components of the 199A Worksheet by Activity Form

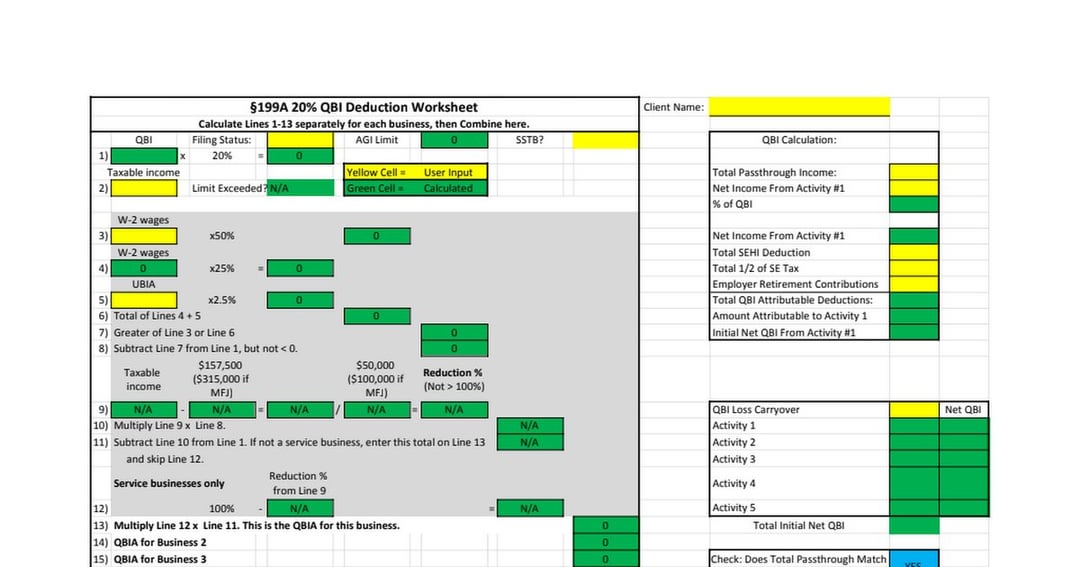

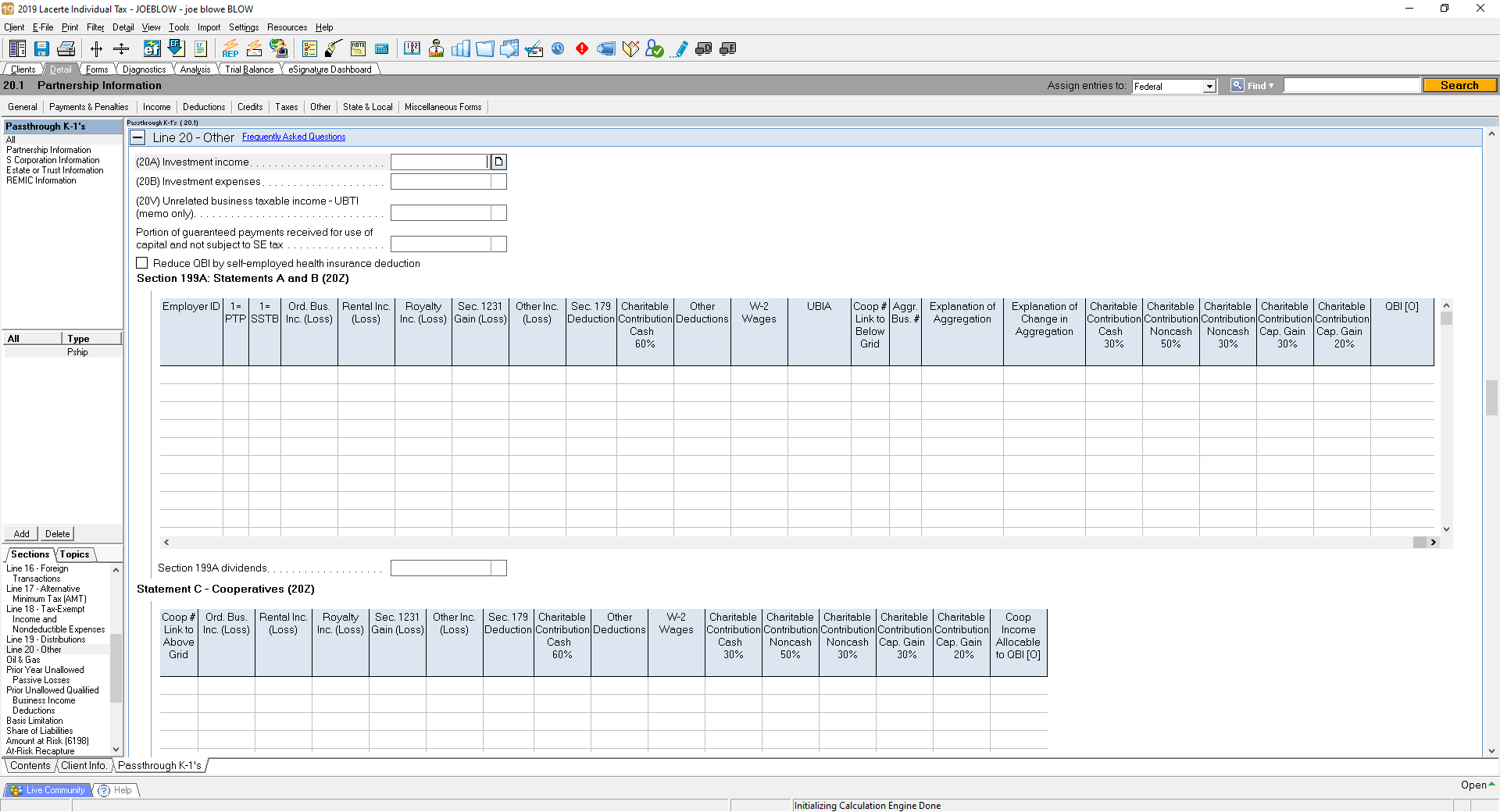

The 199A worksheet is designed to guide taxpayers through the process of calculating their QBI deduction. It requires information about the business’s total qualified business income, the total W-2 wages paid by the business, and the unadjusted basis immediately after acquisition of qualified property. Here are some key components: - Qualified Business Income (QBI): This includes the net earnings from self-employment, guaranteed payments, and certain dividends from a real estate investment trust (REIT) or a publicly traded partnership (PTP). - W-2 Wages: These are the total wages subject to Social Security and Medicare taxes. - Unadjusted Basis Immediately After Acquisition (UBIA) of Qualified Property: This refers to the basis of depreciable tangible property used in a qualified business.

Calculating the QBI Deduction

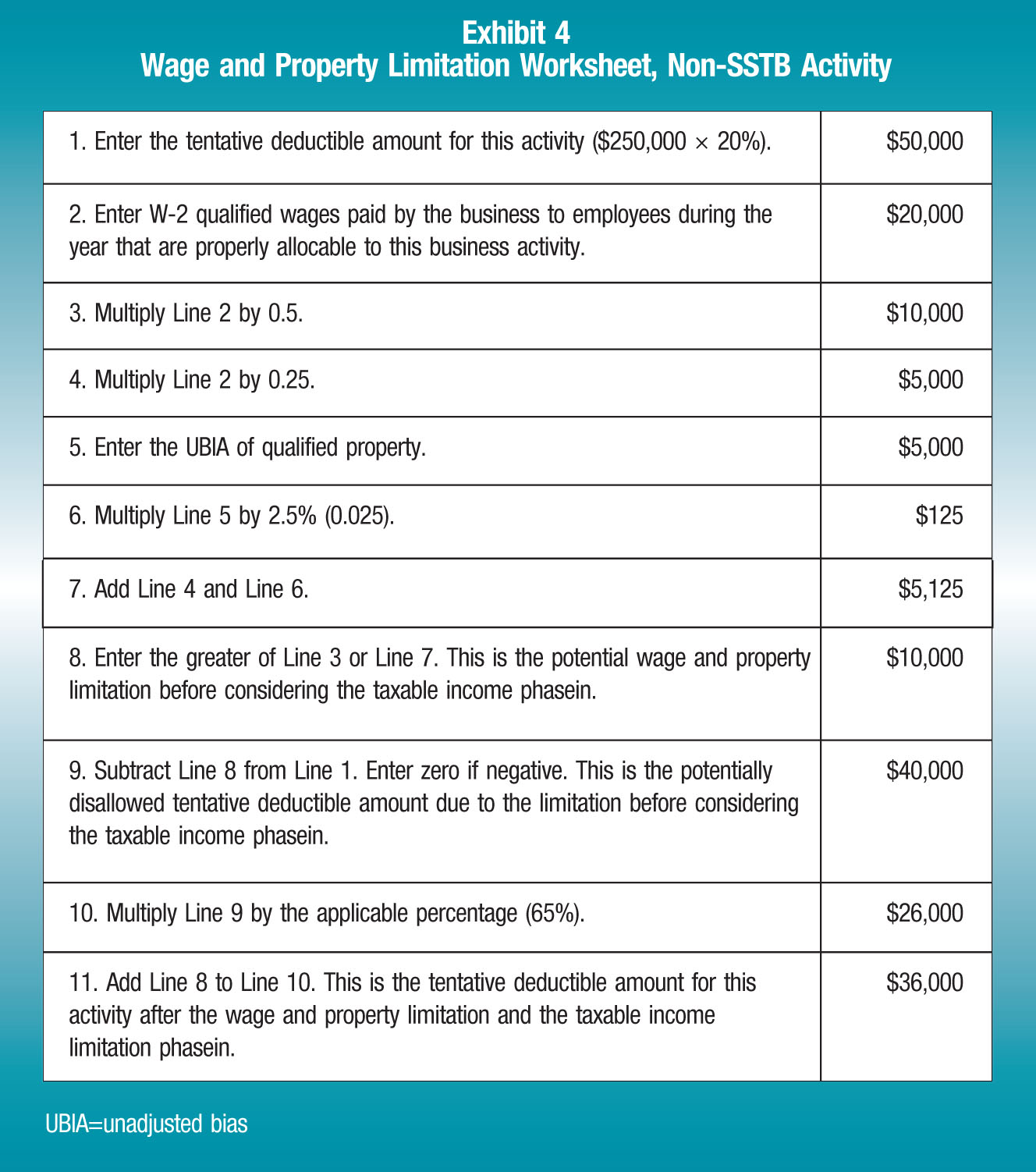

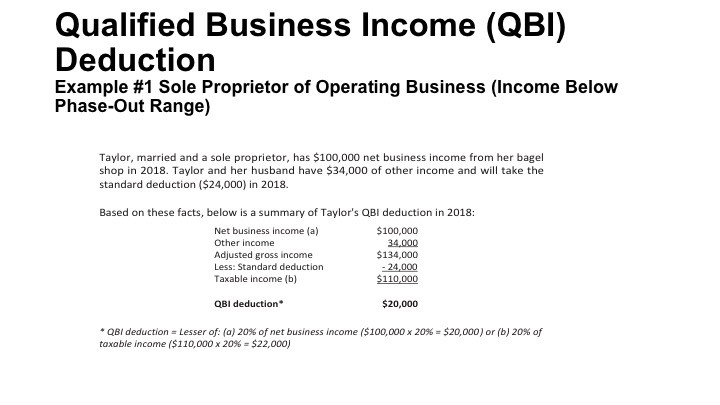

To calculate the QBI deduction, follow these steps: 1. Determine the total QBI from all qualified trades or businesses. 2. Calculate the W-2 wage limitation by multiplying the W-2 wages by 50% (or 25% if the business involves the trade or business of performing services as an employee). 3. Determine the UBIA of qualified property. 4. Apply the limitations based on W-2 wages and UBIA of qualified property. 5. Calculate the net QBI deduction, which is generally 20% of QBI, subject to the above limitations.

Examples of Qualified Trades or Businesses

Qualified trades or businesses include but are not limited to: - Retail and wholesale sales - Manufacturing and construction - Real estate investment (with certain limitations) - Health and medical services - Insurance services - Financial services - Consulting and professional services

Limitations and Phase-Outs

The QBI deduction is subject to several limitations and phase-outs, including: - W-2 Wage Limitation: For businesses with significant payroll, the deduction may be limited to 50% of W-2 wages. - UBIA of Qualified Property: For businesses with substantial investments in qualified property, the deduction may be limited by the UBIA of such property. - Phase-out Based on Income: The QBI deduction begins to phase out at certain income levels (164,700 for single filers and 329,800 for joint filers in 2021).

Notes on Completing the 199A Worksheet

📝 Note: It’s crucial to accurately identify all qualified business income and applicable limitations to ensure the maximum allowable deduction. Consulting with a tax professional can be beneficial, especially for complex businesses or high-income taxpayers.

Conclusion of the 199A Worksheet Process

The 199A worksheet by activity form is a vital tool for businesses aiming to minimize their tax liability through the QBI deduction. By understanding the components of the worksheet, calculating the QBI deduction accurately, and being aware of the limitations and phase-outs, businesses can navigate the complexities of the TCJA and optimize their tax strategy. The process involves careful consideration of qualified business income, W-2 wages, and the unadjusted basis of qualified property, making it essential for businesses to maintain detailed records and seek professional advice when needed.

What is the purpose of the 199A worksheet?

+

The 199A worksheet is used to calculate the qualified business income (QBI) deduction, which can reduce taxable income for certain businesses.

Who is eligible to use the 199A worksheet?

+

Business owners who file Form 1040 and have qualified business income from a domestic business operated as a sole proprietorship or through a partnership, S corporation, trust, or estate are eligible.

What information is required to complete the 199A worksheet?

+

To complete the worksheet, you need information about your business’s total qualified business income, W-2 wages, and the unadjusted basis immediately after acquisition of qualified property.

Related Terms:

- irc 199a explained

- 199a pass through deduction

- section 199a unadjusted basis k1

- section 199a information worksheet

- partners section 199a information worksheet

- section 199a deduction worksheets